Which of the Following Is an Asset Utilization Ratio

We provide solutions to students. The following ratios and data were computed from the 1997 financial statements of Star Co.

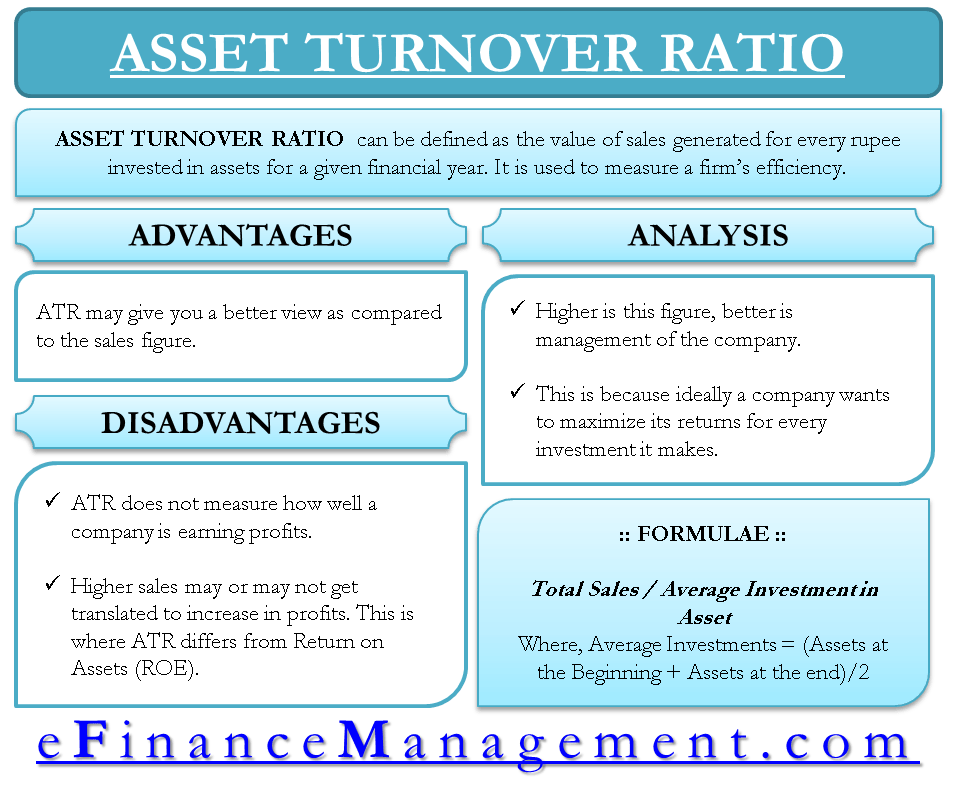

How To Analyze Improve Asset Turnover Ratio Efinancemanagement

Fixed asset turnover is calculated as sales divided by average fixed assets.

. So calculate the solvency ratio from below. Firstly determine the cost of goods sold by the company. Credit utilization impacts credit scores but not debt-to-credit ratios.

Please Use Our Service If Youre. FIXED ASSET ACCOUNTING AND MANAGEMENT PROCEDURES MANUAL Table of Contents. Fixed Asset Turnover.

These ratios the quick and current measure the firms. Damaged beyond repair worn beyond utilization cannibalized or in any other way removed. These ratios measure the firms ability to generate a returnExamples include profit margin return on assets and return on equity.

Suppose a company has higher revenue per employee formula. Interpreting the Asset Turnover Ratio. Identification and tagging of assets will take place in accordance with the following guidelines.

This ratio measures the efficiency and profit earning capacity of the concernHigher the ratio greater is the intensive utilization of fixed assetsLower ratio means under- utilization of fixed assets. Current ratio 15 Working capital P20000 Debtequity ratio 8 Return on equity 2 If net income for 1997 is P40000 the balance sheet at the end of 1997 total assets of. In practice the ratio is most helpful when compared to that of industry peers and tracking how the ratio has trended over time.

Regardless of whether the total or fixed ratio is used the metric does not say much by itself without a point of reference. Wishing for a unique insight into a subject matter for your subsequent individual research. Walmart Balance Sheet Explanation.

It is the summation of all direct and indirect costs that can be assigned to the job orders and it primarily comprises raw material cost direct labor cost and manufacturing. Dmart have the following information available for the financial year-end. The solvency ratio differs from industry to industry so the solvency ratio greater than 20 is considered that the company is financially healthy.

In that case the company is generally doing well and trying to make optimum utilization of the available workforce in its employees. The formula for an operating ratio can be derived by using the following steps. This ratio helps determine how productively a company can utilize its employees and contribute to its business growth.

A lower ratio indicates poor efficiency which may be due to poor utilization of fixed assets poor collection methods or poor inventory management. Higher the solvency ratio good for the company and vice versa. Video Explanation of Asset Turnover Ratio Watch this short video to quickly understand the definition formula and application of this financial metric.

The country has observed a gradual but substantial decline in maternal mortality ratio MMR from 319 per 100000 live births in 2005 to 173 per 100000 in 2017 an average annual rate of. The ratio is calculated by using following formula. Asset utilization ratios measure how effective the firm is at selling its inventory collecting its receivables and employing its fixed assets.

A high turnover ratio can be achieved by outsourcing the more asset-intensive production to suppliers maintaining high equipment utilization levels and avoiding investments in excessively expensive equipment. Curre nt Assets-Inventories Curre nt Liabilities FIXED ASSET TURNOVER RATIO. Creating a budget paying off debts and making a smart saving plan can all.

Comments

Post a Comment